private reit tax advantages

Private REITs that are designed for institutional or accredited investors generally require a much higher minimum investment. Potential drawbacks of private REIT investing.

The list below summarizes a few of the main advantages.

. Ad Leverage PIMCO One Of The Largest Most Diversified Real Estate Managers In The World. Tap Into Broader Resources Such As Macro Analysis Credit Research And Risk Management. Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives.

There are a couple of reasons that partnerships are becoming more. Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. The second primary advantage is long-term capital gains.

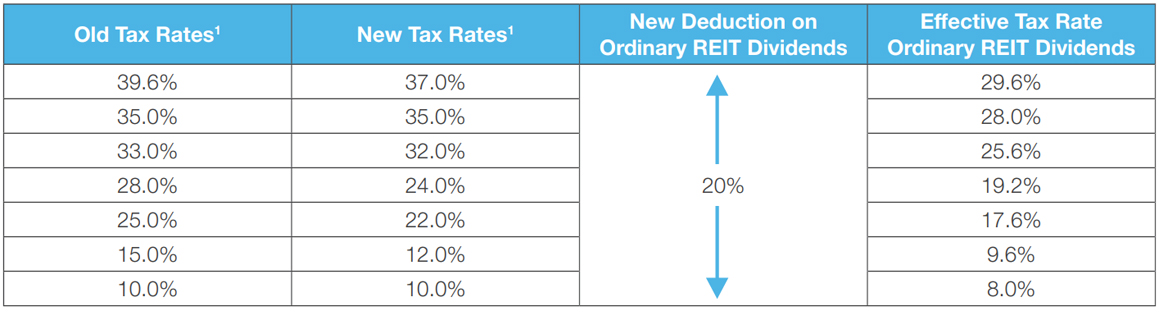

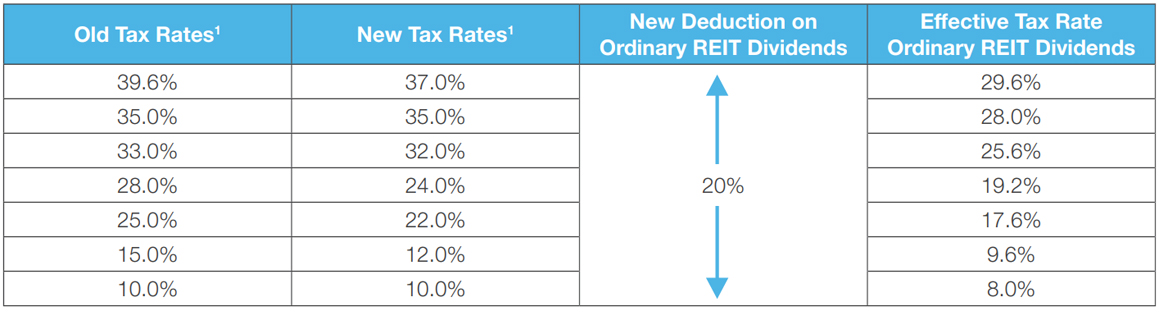

Tax advantage of REITs. McCann Esq and Philip S. REIT investors can deduct up to 20 of ordinary dividends before income tax is.

Entities qualifying for REIT status under the tax code receive preferential tax treatment. If you hold an asset for a year or more you will pay long-term capital gains tax which is much lower than ordinary income. REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment.

REIT investors can deduct up to 20 of ordinary dividends before income tax is. Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. Understanding the Tax Benefits of REITs.

Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios. Tap Into Broader Resources Such As Macro Analysis Credit Research And Risk Management. Limited partnerships and limited liability.

Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Typically 1000 - 25000. Get your free copy of The Definitive Guide to Retirement Income.

Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. The income generated by REITs is not taxed on the corporate level and is.

Private REITs Independent Directors. In its simplest tax form a REIT functions like a hybrid of the two and provides the best of both worlds. If those werent enough reasons to consider investing in a REIT one should also consider the diversification advantages that a REIT can offer such as multiple tenants multiple.

With the advantages in mind its important to mention that there are several important disadvantages to investing in private. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors but.

Ad Leverage PIMCO One Of The Largest Most Diversified Real Estate Managers In The World. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

13 Golden Rules Of Investing In Commercial Real Estate

White Coat Financial Home Facebook

What S A Typical Day For Someone In M A Cost Of Capital Investing Investment Companies

Generating Passive Income With Real Estate Investing

Centurion Apartment Reit Investor Presentation

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business

Your Wealth Secret An Automatic Systematic Accumulation And Investment Program Ezmart4u Investing Systematic Investment Plan Creating Wealth

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

7 Circles On Twitter Marketing Trends Trade Finance Financial Instrument

Pin By Jessica Greene On Love Love Finance Investing Finance Investing

Your Complete Guide To Real Estate Private Equity Investment U

Vanguard Vs Fundrise Which Is The Better Investment Option Fundrise Com Oc Investing Best Investments Vanguard

The Ultimate Spc Guide To Taxes Our Book Club Tax Free Wealth Simple Passive Cashflow

We Re Thrilled To Have Entertainment Financial As An Exhibitor For The 2012 Business Showcase Entertaining Allianz Logo Business

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Esops The Basics And The Benefits Mercer Capital

Restricted Stock Finance Investing Learn Accounting Bookkeeping Business

/income-tax-4097292_1920-bcff7b73c783425889ad73d26a02b33a.jpg)